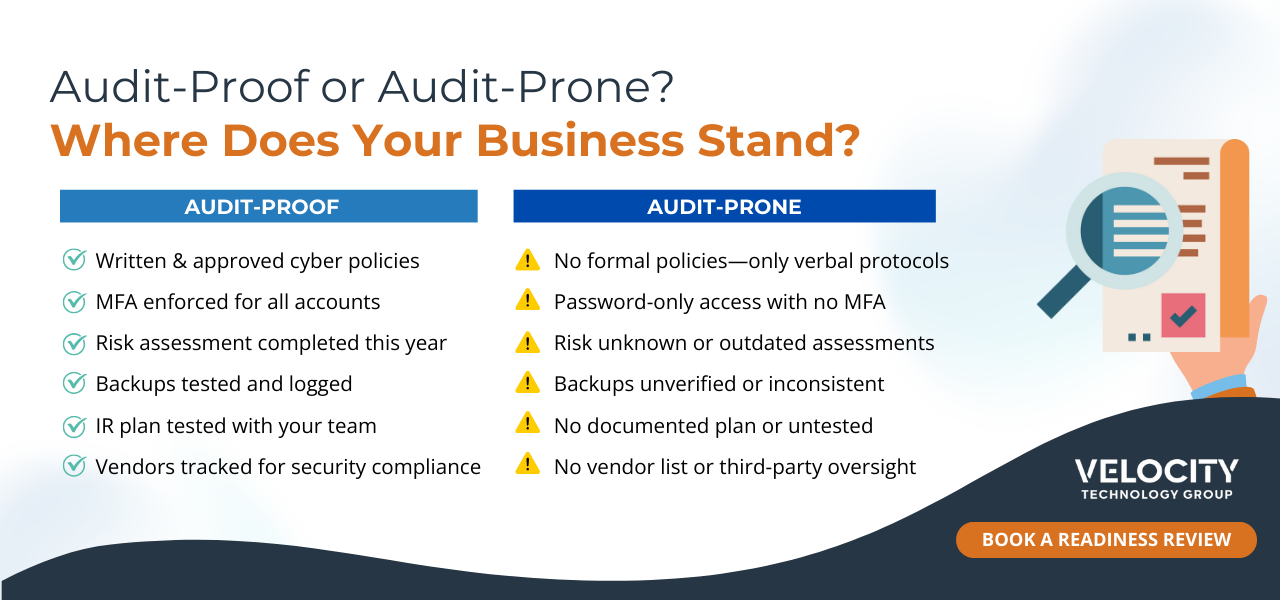

Cybersecurity insurance requirements are getting tougher by the month. According to a 2025 survey by Infrascale, only 4% of U.S. organizations feel fully prepared for a cybersecurity insurance audit, while 19% admit they’re minimally prepared at best. That leaves a wide gap between basic controls and what insurers now expect. Insurers aren’t just looking for policies. They’re looking for proof. It’s not enough to claim you’re managing risk. You need clear documentation and consistent controls that show you’re reducing exposure across the board.

Thank you for reading this post, don't forget to subscribe!And the audit process itself? It’s no longer a box to tick. It’s a benchmark. Insurers are using audits to decide who gets coverage, how much it costs, and what claims they’ll actually pay out. That’s why preparation matters. If your systems, evidence, and processes are ready ahead of time, you’re in a stronger position not just to pass the audit, but to operate more securely every day.

This guide outlines practical steps to help you prepare clearly, confidently, and without scrambling at the last minute. It covers what auditors look for, how to meet those expectations, and how cyber security audit services can support your readiness along the way.

Document Written Cybersecurity Policies

Written cybersecurity policies are one of the first things auditors will ask for and they want more than generic templates. Policies need to be specific to your organization, up to date, and actually followed by your team. If they’re inconsistent, outdated, or missing key topics, that’s a red flag for insurers. Clear documentation shows that your business understands its risks and has a framework in place to manage them.

Auditors often expect to see policies like these:

- Acceptable Use Policy

- Password and Access Management Policy

- Remote Work and BYOD Policy

- Data Classification and Handling Policy

- Incident Response Policy

- Network Security Policy

Review and update these policies at least once a year or whenever there are major changes to your systems, team, or operations. They should reflect how your business operates, not just what sounds good on paper. If a policy says you require MFA but it’s not enforced, auditors will notice the gap.

Store all policies in a central, secure location—somewhere accessible for audits, leadership reviews, and employee reference. It helps to have a version history so you can show auditors how your policies have matured over time. Many companies working with cyber security audit services are also asked to track who has reviewed and acknowledged each policy to close the loop between documentation and action.

Enforce MFA and Role-Based Access Controls

Multi-factor authentication (MFA) is one of the most scrutinized requirements in cybersecurity insurance audits. Insurers want to see that it’s not only available, but fully implemented across your environment. It’s a basic test of your ability to prevent unauthorized access especially in the event of a compromised password.

To meet expectations, MFA should apply to more than just a few applications or admin accounts. Extend it across all business-critical systems, including email, VPNs, cloud storage, and any remote access tools. Prioritize coverage for employees with elevated privileges, but don’t stop there. Everyone in the company should be protected.

Role-based access control (RBAC) on the other hand adds another layer of protection by limiting what users can access based on their job. The goal is to reduce risk exposure by preventing employees from accessing systems or data they don’t need. Insurers and auditors see excessive access as a gap, not a convenience.

To make your access controls audit-ready, you can:

- Regularly review and adjust user access based on current job responsibilities

- Require manager approval for new access requests

- Document and store all access change logs in a centralized system

- Remove access immediately when an employee leaves or changes roles

- Require MFA for all administrative accounts and remote logins

- Periodically test MFA functionality across systems to ensure compliance

These measures not only reduce the risk of internal misuse and external breaches. They also make your controls easier to verify during an audit. Many companies use cyber security audit services to assess access policies ahead of renewal periods and spot any oversights early. Taking this step helps you show auditors that access is limited by design, not just by default.

Maintain a Current Risk Assessment

A current, well-documented risk assessment shows insurers that you understand the threats facing your business and are actively addressing them. It’s about showing that you’ve prioritized and responded to them in a structured way. Auditors will want to see that the assessment is recent, comprehensive, and not just sitting in a folder untouched.

At a minimum, your risk assessment should identify:

- The systems, platforms, and applications critical to your operations

- The types of data you store, process, or transmit

- Known threats and vulnerabilities relevant to your environment

- The likelihood and potential impact of each risk

- Your current mitigation efforts and control gaps

- Who is responsible for each risk area and what actions are in progress

Documenting the risks alone isn’t enough. Insurers look for action: they want to see that you’ve used the assessment to guide decisions whether that’s applying security patches, updating internal policies, or running employee training. Show your work. Keep records of what’s been addressed, what’s underway, and what’s still under review.

If your last risk assessment is older than 12 months, don’t wait for renewal time to update it. Keeping it current gives you leverage when negotiating coverage and helps you catch weak spots before someone else does.

Develop and Test an Incident Response Plan

Insurers expect more than just a written response plan. They want to see that it’s practical, tested, and ready to deploy. An untested plan won’t carry much weight in an audit, especially if your team doesn’t know how to follow it. A strong plan not only outlines your response but also proves your team can carry it out under pressure.

Your incident response plan should include:

- Who is responsible for managing and escalating incidents

- How potential incidents are detected, reported, and confirmed

- Classification guidelines for different incident types and severity

- Communication procedures for both internal teams and external stakeholders

- Clear steps for containment, investigation, and system recovery

- A process for post-incident review, lessons learned, and plan updates

Auditors will check that your plan is documented, assigned to specific roles, and made available to key personnel. It should be reviewed and updated regularly, not just written once and forgotten. Tabletop exercises help confirm your team knows what to do, and give you a chance to adjust the plan based on real feedback.

You don’t need a complex simulation to get value from testing. Even a focused one-hour session can reveal coordination gaps, unclear roles, or missed steps. It’s a low-effort way to improve your readiness and demonstrate to insurers that your response plan is active, not theoretical.

Track Vendor and Supply Chain Risk

Many businesses rely on third parties for key services and auditors know that gaps often begin outside your network. Your vendor risk program needs to show that you not only track who you work with, but actively assess their security posture. This demonstrates to insurers that you’re managing risk beyond your own walls.

You can start by:

- Keeping an up-to-date inventory of all vendors, tools, and service providers

- Classifying vendors by how critical they are and the sensitivity of data they handle

- Requesting security documents like SOC 2 reports, ISO 27001 audits, or equivalent proof

- Reviewing vendors’ breach notification policies and contractual security obligations

- Conducting periodic security assessments or questionnaires, especially for high-risk suppliers

- Tracking remediation steps and follow-up dates for any vendor concerns you uncover

Auditors expect to see evidence of ongoing monitoring not a one-and-done review. That means updating classifications, revisiting contracts, and enforcing requirements if a vendor falls short. Doing so reduces your risk exposure and supports more favorable insurance terms.

Managing vendor risk protects your business and supports stronger audit results. It also builds confidence with your insurance provider, since you’re showing control over risks that could otherwise slip under the radar.

Prove Regular Backups and Patching Activities

Backups and patching may seem like routine maintenance tasks, but during an audit, they carry serious weight. Insurers want to see evidence that you can bounce back quickly after an incident without data loss, extended downtime, or major disruption. That means showing you have a plan, follow it consistently, and can prove it when asked. You’re not just protecting files. You’re protecting the continuity of your entire operation.

For backups, make sure you can show:

- How often you back up critical systems, applications, and data

- Where backups are stored (on-prem, offsite, or cloud-based) and how they’re secured

- Who is responsible for monitoring backup processes and verifying completion

- When you last performed a successful test restore

- How long you retain backup copies and how you handle backup rotation

Just saying “we back up nightly” won’t hold up in an audit. Insurers and auditors want proof such as logs, monitoring dashboards, or screenshots. Make sure that your backup reports are current and easy to access, and that you’ve tested the recovery process recently enough to be confident it works under pressure.

Patching works the same way. It’s not just about keeping systems up to date—it’s about showing control over known vulnerabilities. Auditors want to see that you track patches and apply them on a predictable schedule.

To prepare, keep track of:

- When updates and patches are released by vendors

- How often your team checks for new updates

- The average time between patch availability and deployment

- Any systems that are pending updates and the reasons for the delay

- Who approves and verifies patch installations

These records should be clear, current, and tied to a defined patching process. If you’re using patch management tools, generate reports ahead of time and keep them organized. If you rely on manual tracking, a dated spreadsheet can be enough as long as it’s maintained and accurate.

Get Cyber Security Audit Services to Stay Ready

Staying audit-ready takes more than just good intentions. It takes structure, consistency, and outside perspective. That’s where working with a trusted technology partner makes the difference. Velocity supports businesses by aligning their cybersecurity practices with insurer expectations while easing the pressure on internal teams.

Here’s how our cyber security audit services prep you for insurers:

- Reviews your current documentation and policies to identify gaps before an audit happens

- Helps you implement and monitor controls like MFA, access management, and regular backups

- Supports the development of custom incident response plans tailored to your environment

- Assists in vendor risk reviews, from documentation to contractual requirements

- Tracks patching and remediation activities to ensure systems stay within audit-ready ranges

- Provides ongoing support and guidance as regulations and insurer demands evolve

At Velocity, we work as an extension of your team, giving you the clarity and tools to meet requirements without slowing your operations.

The approach is practical, audit-conscious, and built around how your business actually runs. With the right partner, audit preparation becomes less of a burden and more of a routine part of staying secure.

Prep Today to Minimize Risk Tomorrow

Insurance audits aren’t going away and they’re only getting more complex. But if you stay proactive, they don’t have to be stressful. By putting the right documentation, controls, and processes in place now, you can reduce your exposure, qualify for better coverage, and get more peace of mind. Want to see where you stand or what’s missing? Schedule a cybersecurity audit or consultation with our experts. We’ll help you tighten your defenses, close compliance gaps, and move forward with confidence.

FAQs About Cyber Security Audit Services

What are cyber security audit services?

Cyber security audit services help organizations evaluate and document their security policies, controls, and procedures to meet compliance and insurance requirements. These services identify gaps, provide recommendations, and prepare businesses for insurer or regulatory audits.

Why are cyber security audit services important for insurance?

Insurance providers use audits to decide coverage, premiums, and claims eligibility. Cyber security audit services ensure your documentation, policies, and controls—like MFA, backups, and incident response plans—meet insurer expectations, reducing the risk of denied coverage.

What do auditors look for during a cybersecurity insurance audit?

Auditors typically review written policies, access management controls, risk assessments, incident response plans, vendor risk management, and proof of backups and patching activities. Cyber security audit services help verify that these areas are consistently maintained.

How often should my business use cyber security audit services?

Most organizations benefit from at least one annual review, or whenever there are major system, staff, or compliance changes. Regular audits help keep documentation current, minimize surprises during insurance renewals, and maintain a strong security posture year-round.

How can cyber security audit services help my business?

They reduce audit stress, improve compliance, and strengthen overall security. By identifying gaps early, cyber security audit services give you time to correct issues, improve insurer confidence, and protect your business against costly breaches or downtime.

Recent Comments